Asia’s New Luxury Confidence

For years, Asia powered global luxury through scale. In 2026, the story becomes more nuanced. The region still drives growth, yet the real shift sits beneath the surface: Asian luxury clients have matured, and their confidence now shapes how value, taste and experience evolve.

Having worked across the luxury landscape in Asia for more than a decade, I see luxury moving from imported aspiration to a self-defined expression of culture and identity. The markets progress at different speeds, yet they all point towards greater sophistication, cultural clarity, and a more personal interpretation of what luxury means. This is Asia’s era of self-determined luxury.

If you spend time moving across Asia, you feel this change in practical ways. Within a few hours, you can be in a totally different world — and still expect to be understood and well taken care of. The recognition of value across borders becomes increasingly important.

Ten interconnected trends are shaping luxury in Asia in 2026.

The first five trends describe the demand-side shift: how clients think, choose, travel, and define value. The latter five reflect what brands must now design and build — in experience, trust, and organisational capability.

1. World-Building: The Rise of the Luxury Ecosystem

Luxury in Asia moves beyond stores into worlds. Clients increasingly look for environments that feel cohesive, symbolic and emotionally resonant. Leading maisons no longer depend on a single flagship; they design ecosystems that combine retail, culture, hospitality and private spaces, allowing clients to engage with the brand at different depths.

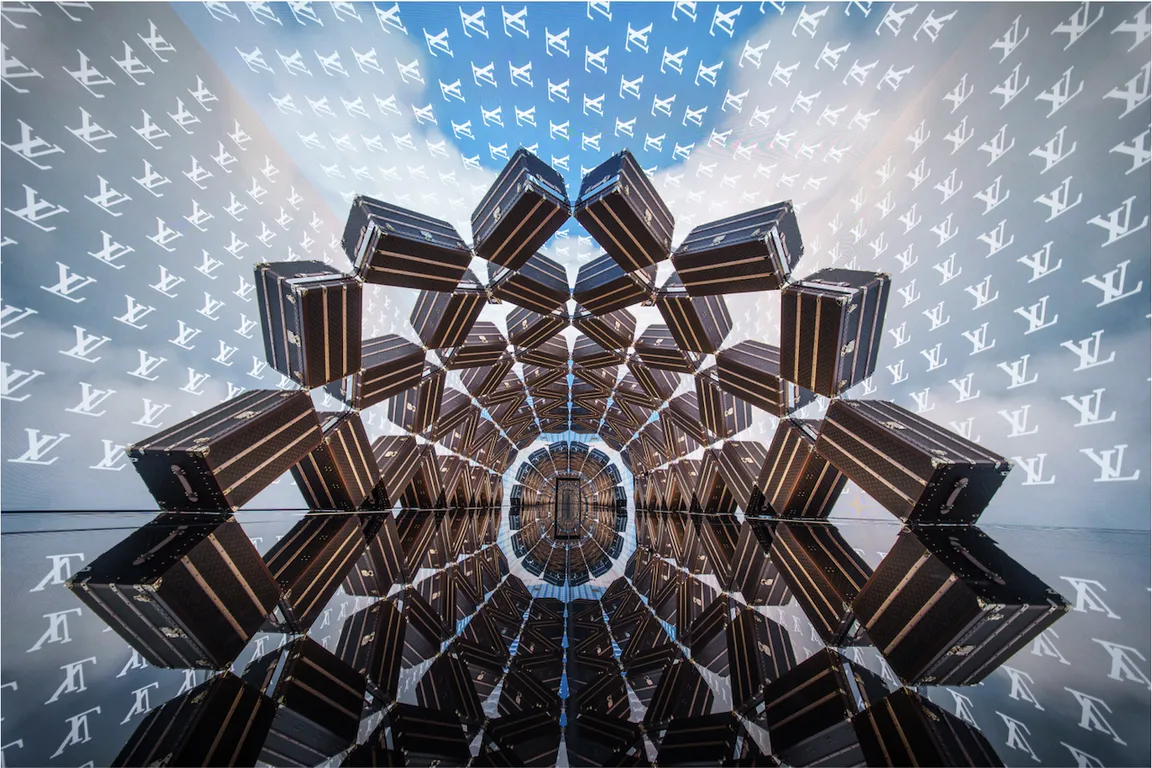

In Bangkok, this is visible in destinations such as Dior Gold House and LV The Place, where exhibitions, cafés, ateliers and retail merge into one continuous experience, allowing transactions to emerge naturally from immersion rather than dominate it. This approach is not episodic. Louis Vuitton continues to extend the same logic across Asia, most recently in Seoul, where its six-storey LV The Place brings retail, exhibition, café culture and fine dining together into one vertical brand world.

At the other end of the spectrum, Louis Vuitton’s L’Appartement in Singapore shows how the same ecosystem becomes quieter and more intimate for top-tier clients, without losing coherence. Portfolio extensions into cafés, chocolate and beauty further widen access while protecting the brand’s centre of gravity. Tokyo completes the picture: Cartier’s Azabudai Hills boutique offers slow, art-led immersion, while its Ginza flagship delivers scale and visibility.

Together, these environments show how world-building becomes a strategic advantage in Asia — shaping how clients feel, move and belong within a brand universe designed for long-term connection, not single visits.

2. Intentional Sophistication: When Taste Replaces Loud Status

A sharper, more intentional luxury mindset defines Asia in 2026. Clients evaluate purchases with far greater intention, favouring craftsmanship and cultural fit over spectacle or seasonal novelty. Luxury signals discernment — how well a piece aligns with one’s identity, taste and lifestyle — rather than how loudly it announces wealth.

This evolution places pressure on brands to deliver depth, clarity and integrity across their collections. The status symbol becomes the ability to choose well, not the volume of what is owned. In Asia’s new luxury landscape, intentionality overtakes accumulation.

Value sits less in visibility and more in alignment — how well a piece, experience, or brand fits one’s identity and way of living. Clients compare quality, provenance, and construction with confidence. For younger affluent audiences, research, transparency, and independent judgement form part of the luxury experience itself.

In 2026, luxury signals maturity through how well one chooses, not how much one accumulates.

3. The Borderless Asian Client: Luxury Without Geographic Anchors

Asian luxury clients no longer shop within a single market. They move fluidly across borders, browsing in one city, testing in another and purchasing where the overall experience feels right. These journeys blend convenience, trust and emotional connection, shaped by how each destination expresses luxury in its own way.

Singapore offers reliability and precision; Tokyo brings ritual and curation; Seoul contributes cultural influence and trend direction; Bangkok adds warmth, hospitality and discovery. Clients understand these nuances intuitively and use short regional trips to enjoy what each city does best — exceptional dining, wellness, craftsmanship or simply the pleasure of a different retail atmosphere.

Value sits quietly in the middle of these decisions. Exchange rates, tax structures and transparent pricing influence timing, yet purchases are driven by confidence and emotional readiness, not price alone.

Brands are part of this choreography. When recognition, service and product availability remain consistent across countries, clients feel understood wherever they land. When these elements fracture, the relationship weakens.

Travelling across destinations becomes important as we want to be recognised across borders. We can be within a few hours in a totally different world, and yet we want to be understood and well taken care of.

4. Clienteling Reframed: Why Human Judgement Still Decides

Personalisation in Asia matures in 2026. Clients expect relevance that feels intentional, not automated — shaped by their preferences, pace and cultural cues, and delivered with accuracy across every channel.

Digital journeys set the standard. Clients move fluidly between social platforms, marketplaces and boutiques, and they expect brands to recognise them at each step. Discovery can start on TikTok, Xiaohongshu or Instagram, comparison happens instantly, and the final purchase may take place online or during a regional trip. Seamless recognition signals competence.

Different profiles value different rhythms. Long-standing buyers respond to subtle continuity built over time. Younger affluent clients engage with faster, tech-supported relevance that mirrors the precision of their wider digital lives.

Technology becomes essential infrastructure. It supports better preparation, more relevant engagements, and smoother continuity across markets. Yet technology alone never creates loyalty. The differentiator remains human intelligence: the ability to read emotion, context and cultural nuance.

In 2026, the strongest clienteling blends structure and intuition — data that supports preparation and people who deliver emotional accuracy.

5. Cultural Confidence: Why Local Fluency Shapes Global Winners

A defining shift across Asia is cultural confidence. Clients increasingly gravitate toward brands — global or local — that understand their aesthetics, values, and daily realities. Domestic players gain momentum by speaking this language fluently, without translation or dilution.

For international maisons, adaptation now goes far beyond surface localisation. Cultural sensitivity demands deeper study, creative interpretation and respect for how luxury codes differ across markets.

In 2026, relevance is earned through fluency. Brands that listen carefully and design with cultural intent build trust. Those that rely on inherited narratives risk sounding distant.

6. Precision Wellness & Longevity: From Indulgence to Outcome

Wellness in Asia moves far beyond relaxation. Affluent clients now seek outcomes — better sleep, metabolic balance, cognitive clarity, emotional stability and long-term vitality. Health shifts from aspiration to routine, with resilience, mental well-being and sustained energy becoming everyday priorities.

Across the region, leading destinations reflect this evolution. Rakxa in Bangkok blends medical diagnostics with traditional therapies, while COMO Shambhala in Bali builds programmes around nutrition, movement and stress recovery. These retreats reflect how regional travellers blend leisure with purposeful renewal.

Wellness also embeds itself into daily life. Wearables, micro-diagnostics, personalised supplements and stress-management rituals shape how clients maintain balance. Luxury properties and residences introduce advanced air and water purification, circadian lighting and access to specialised fitness or recovery communities.

Wellness becomes a status signal — defined by precision, credibility and personal relevance, not opulence. Longevity emerges as one of Asia’s most influential luxury markers.

7. Unplugged Luxury & Slow Rituals: Designing for Presence

Luxury in 2026 moves toward stillness. In a region defined by pace and connectivity, uninterrupted time becomes increasingly valuable. Clients seek environments where attention can settle, where the body can recover, and where experience unfolds without pressure.

This creates a rise in unplugged luxury: device-free spaces, analogue rituals, slower service rhythms and sensory experiences designed to protect presence. Properties and brands that master this create a deeper form of indulgence — one rooted in calm, intentionality and emotional renewal.

Unplugged luxury becomes a quiet status signal: time reclaimed, attention protected and rituals that feel intimate, intentional and deeply human. In a region defined by pace, the rarest currency is calm.

8. Regenerative Luxury & Circular Mindsets: Stewardship Over Ownership

Sustainability in Asia moves beyond “less harm” toward a mindset of restoration, longevity and conscious circulation. Affluent consumers — especially younger cohorts and well-travelled UHNWIs — no longer view responsibility as a virtue; they see it as an essential marker of modern luxury. Value is measured by durability, provenance and the afterlife of a product, not just the moment of acquisition.

This shift propels two parallel behaviours. First, regenerative hospitality and retail concepts take root: properties and brands invest in environmental restoration, local craft ecosystems and resource-positive design. Second, circular luxury matures into a trusted system. Certified pre-owned platforms gain legitimacy for watches, jewellery and leather goods; refurbishment ateliers extend product life with craftsmanship that feels as premium as the original; and upcycling blends sustainability with creativity rather than austerity.

Clients increasingly expect brands to steward both the object and its lifecycle. In 2026, luxury is not only what you buy — it is how responsibly it continues to live.

9. Trust Infrastructure: Transparency as a Design Principle

Trust has become a competitive boundary. Luxury has long relied on mystique, yet today’s clients increasingly ask what justifies value — sourcing, craftsmanship, environmental impact, and pricing logic. Transparency no longer weakens desirability; handled well, it reinforces it.

Digital product passports, provenance tools, and clearer disclosures are becoming part of the luxury experience itself. Still, many brands treat transparency as compliance rather than as design.

The real challenge runs deeper. Transparency demands organisational alignment, data integrity, and the confidence to communicate progress rather than perfection. In 2026, trust is not assumed — it is demonstrated.

10. Leadership, Culture & Capability: The Hidden Differentiator

The final shift sits inside the organisation. Many luxury companies remain structured for a more predictable era — centralised, perfection-driven, and slow to adapt. Yet Asia’s luxury landscape rewards speed, cultural fluency, and empowered decision-making close to the client.

This requires a leadership model that values learning over control, experimentation over replication, and capability-building over short-term optimisation. Retail teams, craftspeople, and client-facing roles increasingly define value creation — and deserve recognition accordingly.

Technology, including AI, plays a critical role as infrastructure, supporting planning, insight, and execution. Technology supports readiness. Culture creates meaning.

In 2026, the most resilient luxury organisations combine discipline with adaptability — honouring core values while evolving how they operate.

Closing Reflections

Luxury in Asia is not becoming simpler — it is becoming clearer. Clients know what they value. They recognise coherence. They sense intention.

For brands, success in 2026 depends less on chasing trends and more on designing systems — experiences, organisations, and cultures — that reflect this maturity. Asia’s new luxury confidence sets a higher bar. Brands that meet it earn loyalty that travels.

All photographs used here serve purely as illustration. All rights remain with their original creators and owners.