The moment that explains the brand

Step into Xintiandi and the change in energy feels immediate. A neat line gathers outside Laopu. Staff move with quiet care — handheld fans and umbrellas in hand — while a nearby café welcomes waiting guests for iced drinks. Inside, the room settles into a hush: filigree pendants, dragon-and-phoenix medallions, a gourd charm for “blessings in abundance”. The symbolism speaks in Chinese; the service speaks in warmth. This is how a home-grown jeweller earns a place in the same conversation as blue-chip maisons — the root of those comparisons: “Cartier of China”, “Hermès of gold.”

What kind of brand is Laopu?

Laopu is Beijing-based and its very name — “old shop” — signals lineage. Shoppers respond to the mix of design clarity, honest pricing, and a human client experience. The brand leans into culture without pastiche, and it wins share against Chow Tai Fook and other established players by making heritage feel current and wearable.

Placement as strategy

The address book tells the story. Over the past two years Laopu has taken space in 30-plus top-tier commercial centres — Grand Gateway 66 (Shanghai), IFC Mall (Hong Kong), SKP Beijing, Plaza 66, and beyond — shoulder-to-shoulder with marquee houses. These placements confer luxury cues, invite direct comparison and support price integrity. Growth remains selective: a relatively small, self-operated network, careful training, and a steady push to earn even stronger positions within malls as performance builds. The centre of gravity still leans Beijing, with deeper moves across first-tier cities.

Singapore shows transferability

At Marina Bay Sands, Laopu meets a sophisticated audience and converts. Early checks show roughly 95% local customers, 90% first-time buyers, conversion above 95%, and four to ten transactions an hour. Many of these clients usually buy from Van Cleef & Arpels, Tiffany & Co., Chow Tai Fook, SK Jewellery, and leading Indian jewellers — real switching, strong product–market fit.

Short version: the mainland proves depth of demand; Singapore shows transferability; the network looks strong.

Why the timing works

- Gold as asset and adornment. A powerful price cycle turns purchases into both hedge and pleasure.

- Guochao with substance. Customers lean into heritage and identity; cultural codes resonate when pieces wear easily, every day.

- DIY fascination. A youth wave melts bars, heirlooms and gold beans into personalised jewellery; content at huge scale feeds desire for pure-gold, craft-led design.

The engine: clarity, culture, care

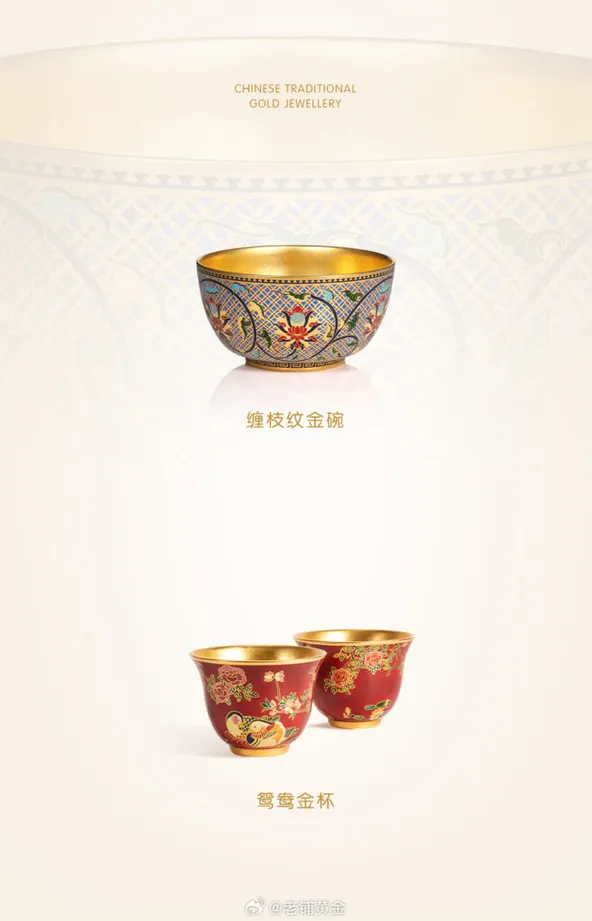

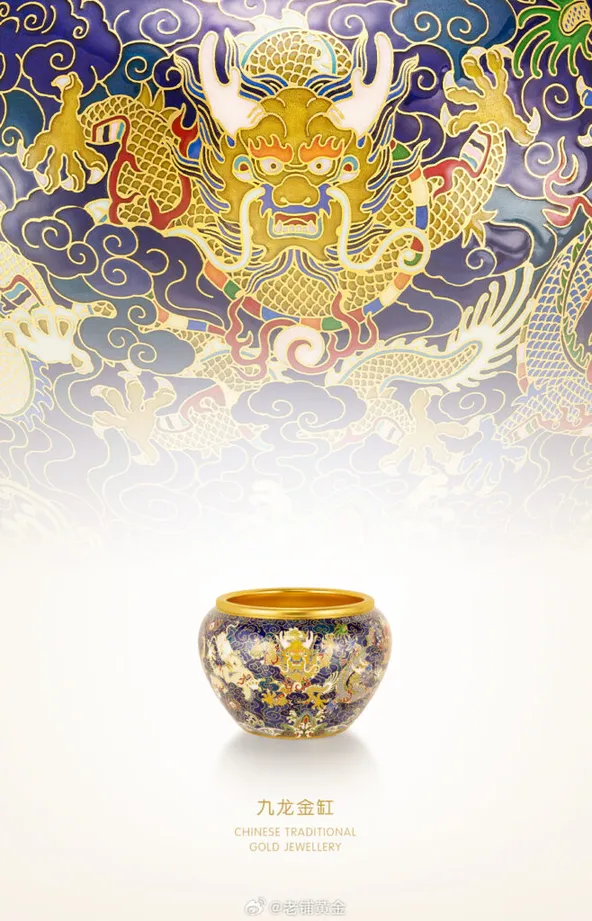

Fixed pricing replaces weight-plus-labour haggling and supports healthy gross margins. Clear tickets free teams to teach the craft, rather than negotiate grams. Techniques range from hammering and filigree to inlay and enamel; the catalogue refreshes each year with a balanced cadence — half new, half evolutions — which sustains heat without fatigue. Ming-inspired interiors and discreet VIP salons lend the calm of a study rather than the bustle of a shop. Queue hospitality — fans, umbrellas, café welcome, a touch of Evian and Godiva — turns waiting into experience, and experience into advocacy. Pricing stays disciplined and sticky, which protects equity and supports value perception in the secondary market.

The industry pays attention

Bernard Arnault, chairman and chief executive of LVMH, walked into Laopu’s IFC Shanghai boutique last week and spent around half an hour with the pieces, reportedly calling several of them “exquisite” and “intriguing.” That visit signals real interest at the very top of the industry. It also underlines what sets Laopu apart right now: materiality with weight, symbolism with clarity, a measured retail pace, and a service style that feels warm and assured.

The business picture — momentum with discipline

Revenue and profit step up at speed; the Hong Kong listing brings fresh scrutiny and a sharper multiple. The next phase relies on classic luxury execution: deeper finish and detailing, a steady design cadence, generous client rhythm as queues evolve into communities, and continual elevation as lookalikes crowd the edges. Sustain those, and brand power compounds.

What luxury teams can take from Laopu

- Choose front-row addresses to earn the right to a luxury conversation and support price.

- Teach the product — pricing clarity and craft education build belief faster than promotions.

- Design hospitality into the journey — warmth and respect create stories people share.

- Code the culture — symbols with meaning travel when design stays wearable.

One line that sums it up

Laopu’s playbook is simple: prime placement, fixed pricing, culture-led design, and courteous hospitality. Mainland proves demand; Singapore shows transferability; peers across the industry are watching.

Final Thoughts

Laopu reads like a system rather than a moment: placement + pricing clarity + cultural craft + hospitality, tuned to a consumer mood that values identity, value retention and respect at the counter. In a market long dominated by European houses, this feels like a confident Chinese answer with its own voice — refined, modern, and unmistakably warm.